We at Taxor are launching a blog where we discuss GST notices, their resolution, and what you should do if you receive one. In this first post, we discuss the Rental RCM-related Notice that we got at our company. Nothing like a hands-on experience!

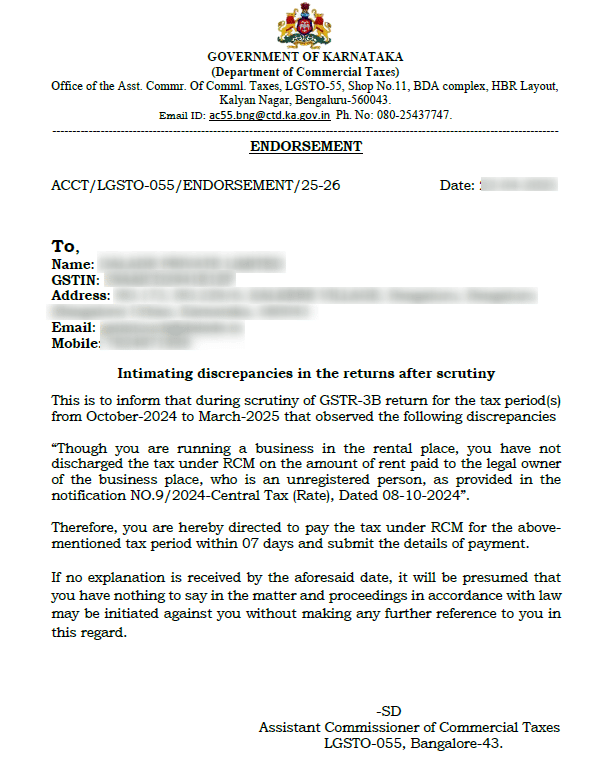

The notice could hit your inbox from a very unassuming email ID. We got ours from : [email protected] with the subject line “ENDORSEMENT”. So watch out!

A screenshot of the notice we received is attached below.

Why Did We Get This?

Here is a table of the GST Registration status of your business, your landlord’s, and what that means for you while filing your GST returns.

Your Company | Your Landlord | What’s On You |

|---|---|---|

Registered | Registered | Business as usual. You pay rent and GST → landlord files it and you get ITC |

Registered | Unregistered | RCM Territory |

Unregistered | Registered | Business as usual. You pay rent + GST and get on with life |

Unregistered | Unregistered | Nothing, chill! You shouldn’t even be here. |

Caveat here - this is considering that you are using the rented property for business or commercial activities and not personal or exempted purposes.

A quick word on what RCM means - for the uninitiated:

Normally, with GST, during a transaction between 2 businesses, the seller collects tax from the buyer and deposits it to the tax authorities. In certain scenarios, the Government finds it simpler to shift the responsibility of paying tax on a transaction to the buyer. E.g., when the seller is unregistered under GST or is a business registered outside India (Imports), etc. If you are the buyer in such a transaction, you are responsible for reporting it to the GST department via RCM via GSTR-3B.

In many cases, such as this rental RCM, you could claim ITC for this transaction within the same 3B form and therefore end up not shelling out any actual money from your business towards this. So here it serves more like a mechanism for the exchequer to expand the tax base and maintain accountability in the supply chain.

What Do You Do If You Ever Face This

Firstly, talk to the folks who are responsible for GST filing within your team or your consultant (if outsourced like us) since they are the ones who will do the work.

The following information is for your awareness, as the next steps would be undertaken by them:

A response has to be sent to the notice email acknowledging the matter and informing the Dept. that you are working on it.

Next is the actual work. All of this has to be done while filing your 3B Returns; nothing needs to be done in GSTR1.

Calculate the rent that you have paid so far until receiving the notice - GST is 18% of your rent (CGST 9%, SGST 9%).

In your GST Portal, an “Electronic Cash Ledger” entry for this amount has to be created. This should reflect in Section 3.1(d) Inward supplies (liable to reverse charge) of your 3B Form.

Once this Cash payment is recorded, ITC can be claimed for the entire amount in the same month as the ITC. This is reflected in Section 4(3) Inward supplies liable to reverse charge (other than 1 & 2 above) of your 3B Form.

Thus, effectively, you end up NOT shelling out any money towards GST on rental RCM.

Some Side Notes

RCM applicability on the rent amount if the landlord is unregistered and the tenant is registered is in place from October 10, 2024.

Everything here is generalised and simplified for your understanding. There could be edge scenarios. So talk to your CA or tell us about your specific scenario in the comments section and we will provide you the right directions if that is what you are looking for.

So, that’s it, guys. Do subscribe to the blog if you found this useful, to show us some encouragement, and want more such posts delivered right to your inbox. Also, drop your questions and suggestions, if any, in the comments section below (possible only if you subscribe).